Data, APIs & Platform Infrastructure Data & API Essentials: Powering Your Algorithmic Trading

Part 2: Data, APIs & Platform Infrastructure Data & API Essentials: Powering Your Algorithmic Trading

Data is the fuel that drives any algorithmic trading system. Without high-quality, reliable market data, even the best trading strategy can falter. In this section, we discuss the different types of data essential for trading and explore how to access that data through various APIs.

Why Quality Data Matters

- Historical Data: Used for backtesting strategies, this includes daily, intraday, or even tick-level data.

- Real-Time Data: Live feeds that provide up-to-the-second (or even millisecond) updates for executing trades.

- Fundamental and Alternative Data: Information like earnings reports, economic indicators, news, and even social media sentiment can enrich your strategy.

The Yahoo Finance API and Alternatives

Yahoo Finance API:

While Yahoo discontinued its official API years ago, the community has developed excellent libraries—most notably, the Python library yfinance. This tool provides access to historical data, real-time quotes, fundamental metrics, and more. It’s especially popular among retail and independent traders for its ease of use and free access.

Here’s a simple code example that demonstrates how to retrieve historical data using yfinance:

import yfinance as yf

# Define the ticker symbol and time range

ticker_symbol = "AAPL"

start_date = "2020-01-01"

end_date = "2021-01-01"

# Fetch historical daily data for Apple

data = yf.download(ticker_symbol, start=start_date, end=end_date, interval="1d")

print(data.head())

This snippet downloads Apple’s daily OHLC (Open, High, Low, Close) data, which can be used for backtesting strategies or feeding a real-time trading model.

Other Data Sources:

- Alpha Vantage: Offers free and premium tiers with JSON data for stocks, forex, and cryptocurrencies. Great for beginners, though it comes with API rate limits.

- IEX Cloud: Provides free and paid access to U.S. market data with a focus on real-time quotes and fundamentals.

- Finnhub, Polygon.io, Twelve Data: These services offer competitive features, broad market coverage, and varying price points, making them suitable for traders with different needs.

When selecting a data provider, consider coverage, data frequency, latency, and cost. For many algorithmic traders, starting with free sources like Yahoo Finance and Alpha Vantage is a sensible approach—then upgrading to premium feeds as your strategy scales and requires greater precision.

Platforms & Infrastructure: From Code to Execution

Even the most refined trading algorithm requires a robust infrastructure to execute trades in real time. This section explores how to set up your trading system—covering broker APIs, trading platforms, and the best practices for deployment.

Trading Platforms and Broker APIs

Interactive Brokers (IB):

Widely regarded as a top choice for U.S. algo traders, Interactive Brokers offers a comprehensive API that supports multiple asset classes (stocks, options, futures, forex, and more). Key points include:

- Robust API: IB provides support for languages such as Python, Java, C++, and C#. Libraries like

ib_insyncsimplify API interactions, allowing you to focus on your trading logic. - Trader Workstation (TWS) and IB Gateway: These applications serve as the interface between your algorithm and the markets, handling order routing and real-time data.

- Paper Trading Environment: IB’s simulated trading accounts let you test your bot under live market conditions without risking real capital.

Other platforms like TradeStation, NinjaTrader, and even emerging solutions like Alpaca (an API-first commission-free broker) provide viable alternatives depending on your trading style and asset class.

Building a Trading Bot: Infrastructure Considerations

Developing a trading bot isn’t just about writing code—it’s about ensuring that your system runs reliably, securely, and efficiently. Consider these key components:

Runtime Environment:

- Local vs. Cloud: While you might develop your bot locally, deploying it on a cloud-based VPS (e.g., AWS, Azure, or DigitalOcean) ensures 24/7 uptime and faster execution.

- Geographic Proximity: For latency-sensitive strategies, choose a server location close to the exchange’s data center (for example, a server in North Virginia for U.S. equities).

System Architecture:

- Modularity: Divide your bot into clear modules such as data acquisition, signal generation, order execution, and logging. This not only simplifies development but also aids in troubleshooting.

- Resilience: Build in fail-safes and redundancy. Your system should be able to handle network disruptions, reconnect automatically, and alert you if something goes wrong.

- Security: Safeguard your API keys and credentials. Use secure protocols (like SSH) and keep your server’s software updated to protect against breaches.

Monitoring & Alerts:

- Set up logging to record trades, errors, and system performance.

- Implement alert systems (via email, SMS, or a dashboard) to notify you of critical issues, such as significant trading losses or connectivity problems

A Practical Walk-Through: Deploying Your Bot

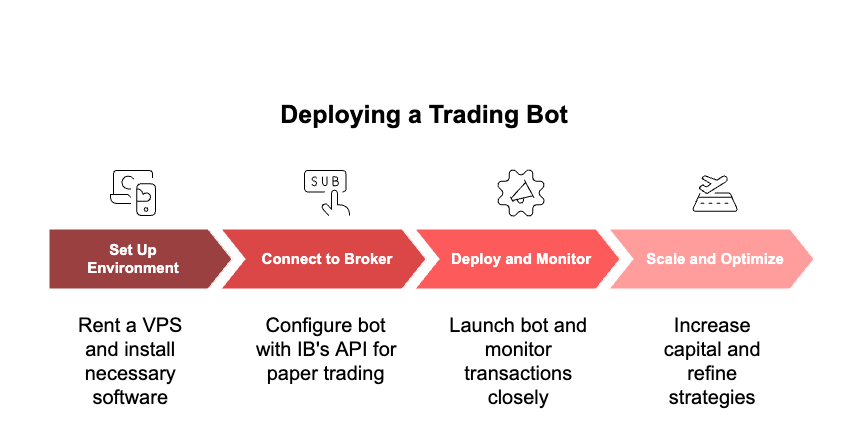

Imagine you’ve developed a trend-following strategy on U.S. equities. After thorough backtesting, you’re ready to deploy. Here’s how you might proceed:

Set Up Your Environment:

- Rent a VPS in a region close to the exchange’s servers.

- Install necessary software (Python, your trading libraries, and IB’s TWS or IB Gateway).

Connect to Your Broker:

- Configure your bot to connect to IB’s API. Enable paper trading mode initially to test order execution in a live-like environment.

- Use the API to subscribe to real-time data feeds for your target stocks.

Deploy and Monitor:

- Launch your trading bot to start processing live data.

- Ensure it logs all transactions and monitor it closely for the first few days.

- Once confident, gradually switch from paper trading to real trading with modest position sizes.

Scale and Optimize:

- As your strategy proves robust, consider scaling up the capital allocation and possibly adding more strategies or asset classes.

- Continuously refine your bot by incorporating feedback, updating risk parameters, and optimizing code performance.

Conclusion: Bridging Strategy and Execution

Data and infrastructure are the backbone of successful algorithmic trading. In this part, we’ve explored how to harness free and premium data sources—using APIs like Yahoo Finance—and how to build a robust, secure trading environment with reliable platforms like Interactive Brokers. By carefully selecting data providers, ensuring seamless broker connectivity, and building resilient systems, you can confidently deploy your trading strategies in the fast-paced U.S. markets.

As you advance, remember that a sound infrastructure not only supports your strategy but also provides the flexibility to evolve as market conditions change. Keep testing, optimizing, and scaling responsibly, and your algorithmic trading system will serve as a solid foundation for long-term success.

For those eager to delve deeper into each component, check out our blog on “Choosing the Right Trading Platform: Tools, Bots & Automated Systems” for further insights on platform selection and automation tools.