Mastering Algorithmic Trading with Pyfolio: A Complete Guide for Python Professionals

Algorithmic trading demands precision, adaptability, and innovative tools to optimize performance, and Pyfolio has emerged as an essential solution in this domain. Combining robust analytical capabilities with intuitive integration, it not only generates detailed performance reports (“tear sheets”) but also leverages Generative AI to predict potential improvements in trading strategies. According to QuantInsti, Pyfolio’s tear sheets analyze returns, risk exposure, and drawdowns, providing actionable insights to traders.

Generative AI further enhances these insights by simulating various scenarios, helping traders understand the impact of potential changes in their strategies before implementation. Pyfolio’s seamless integration with Python libraries like Zipline, for historical backtesting, and Pandas, for data manipulation, allows for efficient end-to-end workflows. Together, these tools empower traders to make informed decisions grounded in data and enriched by AI-generated predictions. In this article, we explore it’s standout features, its synergy with Generative AI, and why it has become indispensable in modern algorithmic trading.

Why Pyfolio is a Critical Tool for Python Algorithmic Trading Professionals

In the competitive landscape of algorithmic trading, actionable insights can mean the difference between success and failure. Pyfolio, enhanced by Generative AI capabilities, simplifies complex trading analytics by providing traders with the tools they need to predict and adapt strategies effectively:

- Evaluate Strategy Performance: With detailed tear sheets summarizing cumulative returns, volatility, and drawdowns, traders can benchmark their success and pinpoint areas for improvement. Tear sheets consolidate a wealth of data into an accessible format, enabling quicker decision-making.

- Analyze Risk Metrics: Pyfolio assesses both systematic and unsystematic risks with precision. This ensures strategies are not only profitable but also resilient to adverse market conditions.

- Visualize Data Intuitively: From rolling beta charts to return distribution plots, it’s visualization tools translate raw data into actionable narratives, making it easier to interpret complex metrics.

As an open-source library, It democratizes access to professional-grade tools. Its availability levels the playing field for both retail traders and institutional investors, fostering innovation across the board.

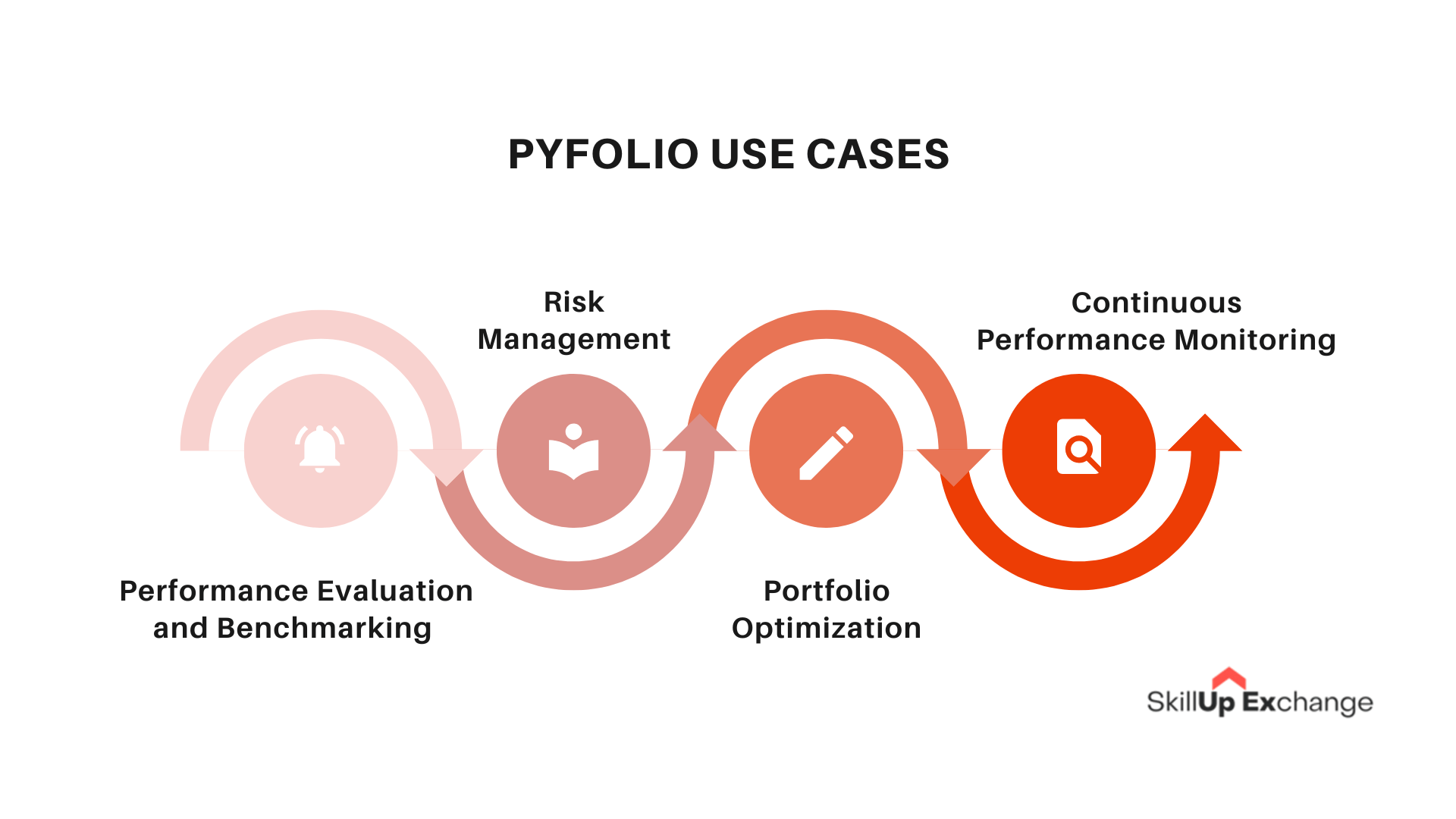

Use Cases

1. Performance Evaluation and Benchmarking

Performance evaluation is the cornerstone of trading success. it’s tear sheets, powered by Generative AI predictions, consolidate critical metrics such as Sharpe Ratio, Sortino Ratio, and annualized returns. These comprehensive reports allow traders to:

- Compare strategy performance against benchmarks and industry standards.

- Identify strengths and weaknesses in their trading approaches, enabling continuous refinement.

2. Risk Management

Risk management is an indispensable aspect of trading, and Pyfolio, complemented by Generative AI insights, offers robust tools to:

- Understand Market Sensitivity (Beta): Evaluate how strategies react to broader market trends.

- Measure Drawdowns: Track maximum potential losses and typical recovery durations, offering insights into a strategy’s robustness.

3. Portfolio Optimization

With Pyfolio, traders can analyze multiple strategies side by side, identifying optimal asset allocations. Generative AI further enhances this by simulating diversification scenarios, helping traders craft portfolios capable of weathering market volatility while maintaining consistent returns.

4. Continuous Performance Monitoring

Pyfolio’s real-time analytics tools allow traders to dynamically adjust their strategies in response to market changes, ensuring sustained competitiveness in fluctuating environments.

Integrating Pyfolio with Other Libraries

The true power of Pyfolio lies in its seamless integration with the broader Python ecosystem, enhanced further by its adaptability to incorporate Generative AI insights, making it a dynamic tool for traders.

Zipline Integration

As a Python-based backtesting library, Zipline complements Pyfolio by simulating trading strategies using historical data. This integration creates a streamlined workflow:

- Backtest strategies with Zipline to validate historical performance.

- Analyze metrics and visualize results with Pyfolio’s tear sheets for actionable insights.

Pandas for Data Manipulation

Pandas, a staple for data preprocessing, works seamlessly with Pyfolio. Traders can clean and aggregate financial data before feeding it into Pyfolio, ensuring accuracy in performance analysis.

Open-Source Flexibility

Being open-source, it encourages customization, enabling traders to build workflows that meet their unique needs. Its modular structure allows integration with additional libraries or tools as required.

How Pyfolio Enhances Backtesting

Backtesting is vital for validating trading strategies, and it’s capabilities, bolstered by Generative AI, elevate this process by providing in-depth performance analysis, visualizations, and predictive insights for future market conditions.

Step-by-Step Guide

- Run Backtests: Simulate trades using historical data with Zipline or other backtesting frameworks.

- Extract Metrics: Collect key data points such as returns, positions, and transactions.

- Generate Tear Sheets: Use Pyfolio to create performance reports with a single command:

import pyfolio as pf pf.create_full_tear_sheet(returns, positions=positions, transactions=transactions)

Key Visualizations

- Cumulative Returns: Measure portfolio growth over time.

- Rolling Volatility: Monitor dynamic changes in risk levels.

- Drawdown Analysis: Highlight periods of significant capital loss to understand vulnerabilities.

It’s tools ensure traders have a granular understanding of their strategy’s effectiveness, preparing them for live deployment.

Analyzing Transaction Costs and Slippage with Pyfolio

Transaction costs and slippage can erode trading profits. It allows traders to account for these factors in their analyses:

Incorporating Transaction Costs

By integrating with frameworks like Zipline, it enables traders to model transaction costs accurately. For example:

from zipline.finance import commission, slippage

set_commission(commission.PerShare(cost=0.01))

set_slippage(slippage.FixedSlippage(spread=0.01))Visualization of Cost Impact

Pyfolio’s adjusted performance metrics help traders compare raw returns with those accounting for transaction costs, providing a realistic view of profitability.

Visualizing Financial Metrics with Pyfolio

Effective data visualization can transform raw metrics into actionable insights. It’s suite of visualization tools, now enriched with Generative AI capabilities, excels in helping traders identify trends, simulate outcomes, and make informed decisions.

Key Charts

- Cumulative Returns: Demonstrates overall profitability.

- Drawdown Analysis: Tracks periods of maximum capital loss.

- Return Distributions: Analyzes the consistency and reliability of returns.

Best Practices

- Use Pyfolio’s comparison features to evaluate multiple strategies simultaneously.

- Customize charts for clarity and relevance to the audience.

- Leverage rolling metrics for real-time risk management insights.

Why Pyfolio is the Future of Algo Trading

The accessibility and versatility makes it as a cornerstone for algorithmic trading. Here’s why:

Advantages

- Cost-Effectiveness: Being open-source, it removes financial barriers for traders.

- Community Support: Python’s active user base offers extensive resources, from tutorials to forums.

- Customization: It’s modular design allows traders to tailor it to specific needs.

Industry Impact

As algorithmic trading becomes increasingly data-driven, it’s features ensure traders remain competitive by delivering powerful analytics at no cost. Additionally, its integration with Generative AI provides predictive modeling capabilities, making it a game-changer for professionals aiming to stay ahead in dynamic markets. Generative AI not only helps simulate future scenarios but also provides actionable recommendations for strategy optimization.

For a deeper dive into the evolving landscape of Python-based algorithmic trading, check out our blog: Why FinGPT is Redefining Python Algo Trading for Professionals. This article explores how Generative AI is driving innovation and reshaping trading strategies for maximum impact. Together, tools like Pyfolio and FinGPT are setting new benchmarks in financial analytics and algorithmic precision.

FAQs

-

What is Pyfolio used for in algorithmic trading?

Pyfolio is a Python library used for performance and risk analysis in algorithmic trading. It provides comprehensive tear sheets, risk metrics, and visualizations to evaluate trading strategies.

-

How does Pyfolio integrate with other Python libraries?

Pyfolio integrates seamlessly with libraries like Zipline for backtesting and Pandas for data manipulation, enabling traders to streamline workflows and optimize strategies.

-

Can Pyfolio account for transaction costs and slippage?

Yes, Pyfolio can analyze transaction costs and slippage by working with frameworks like Zipline. Adjusted performance metrics help traders assess real-world strategy viability.