Automated Trading vs. AI Agent Trading: What’s the Difference?

Automated Trading vs. AI Agent Trading: What’s the Difference?

Trading stocks used to be done by people making decisions on the trading floor. Today, computers play a huge role in trading. But not all computer trading systems work in the same way. In this blog post, we explain the differences between two types of computer trading: automated trading and AI agent trading. We will look at how each works, what kind of data they use, and the pros and cons of each method—all in simple language that’s easy to understand.

Whether you’re just starting out or have some trading experience, understanding these differences can help you make smarter decisions.

What Is Automated Trading?

The Basics

Automated trading uses computer programs to follow fixed rules. Think of it like a robot that always follows a recipe. For example, you might set a rule: “Buy a stock when its price drops 5% below a certain level and sell it when the price rises 5% above that level.” Once you set these rules, the system will work exactly as programmed, without any changes.

This type of trading has been around for decades. It is fast and works without emotions. However, one big problem is that if the market changes suddenly, the robot cannot change its rules on its own.

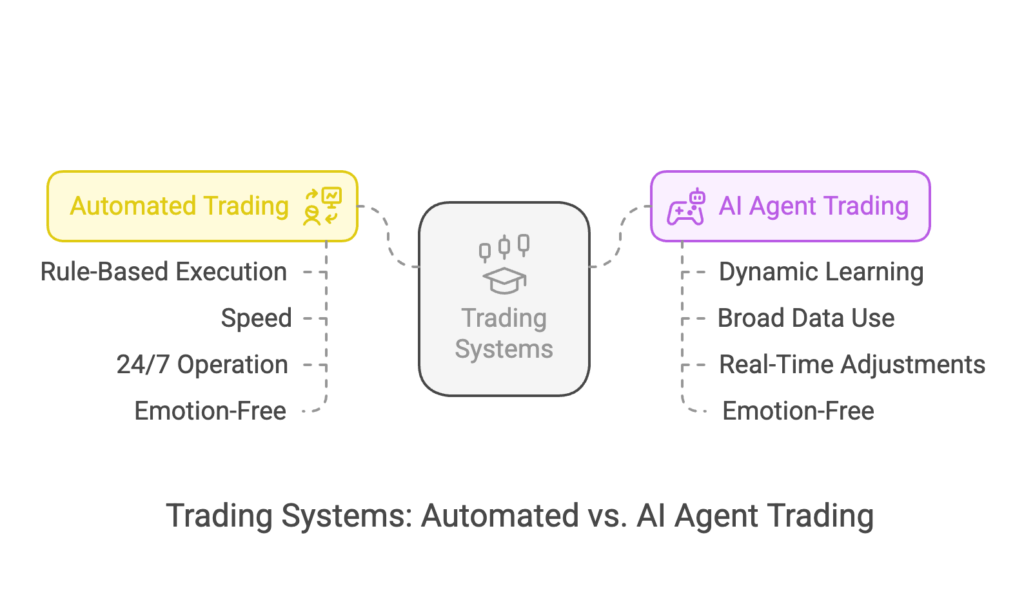

Key Features of Automated Trading:

- Rule-Based Execution: The system always follows the same rules.

- Speed: Trades are done in milliseconds—much faster than a person can react.

- 24/7 Operation: The system never takes a break.

- Emotion-Free: It never gets scared or greedy.

When It Works Best

Automated trading is great when the market is steady. If the market behaves the same way it has in the past, these systems do their job very well. But when unexpected events occur, they may not react as quickly because they can’t change their rules on the fly.

What Is AI Agent Trading?

The Next Step in Computer Trading

AI agent trading is like the next level of automated trading. Instead of following fixed rules, AI agents learn from data. They use techniques called machine learning and deep learning to study past market behavior and then adjust their actions based on new information.

Imagine you have a smart robot that learns from every trade it makes. It looks at old stock prices, news stories, and even social media posts to find patterns. As it learns more, it changes its strategy by itself. This ability to learn and adapt is called agentic trading.

For more details on how AI is changing stock trading, check out our post AI Agents for Stock Trading: The Future of Investing.

How AI Agents Work

AI agents use many types of data to make predictions:

- Historical Data: They study past stock prices to spot trends.

- Real-Time Market Data: They get the latest prices and volumes as they happen.

- News and Social Media: They use special tools to understand if the news is good or bad for a company.

- Alternative Data: This might include satellite images or mobile phone data to see early signs of how companies are doing.

Studies like When AI Meets Finance (StockAgent) and A Multimodal Foundation Agent for Financial Trading show that combining many types of data can make predictions even better.

Key Benefits of AI Agent Trading:

- Dynamic Learning: The system learns and improves over time.

- Broad Data Use: It uses lots of different data sources for a fuller view.

- Real-Time Adjustments: It can change its strategy quickly when the market changes.

- Emotion-Free: Like automated trading, it does not get affected by feelings.

Comparing Automated Trading and AI Agent Trading

| Aspect | Automated Trading | AI Agent Trading |

|---|---|---|

| Flexibility | Follows fixed rules that never change unless manually updated. | Learns from new data and changes its strategy automatically. |

| Data Use | Uses mostly historical price data and a few technical indicators. | Uses a wide range of data: historical data, real-time data, news, social media, and even satellite images. |

| Decision Process | Simple if-then rules (if condition A, then trade). | Uses complex models that weigh many factors and adjust based on continuous learning. |

| Transparency | Easy to understand because the rules are clear. | Often seen as a "black box" because the decision process can be hard to explain. |

| Performance | Works well in stable markets but may miss opportunities when the market changes suddenly. | Tends to perform better in changing markets due to its ability to adapt and update continuously. |

Advantages and Limitations: Which System Is Right for You?

Here’s another table that lays out the Advantages and Limitations of each system in simple terms:

| Aspect | Automated Trading | AI Agent Trading |

|---|---|---|

| Advantages | Simplicity: Easy to set up with fixed rules. Reliability: Works consistently in steady markets. Speed: Trades very fast. No Emotions: Not affected by feelings. | Dynamic Learning: Learns and adapts with new data. Broad Data Analysis: Uses many types of data for a complete view. Better Risk Management: Quickly changes strategy to reduce losses. No Emotions: Makes decisions based on data only. |

| Limitations | Fixed Rules: Can’t adapt unless rules are changed manually. Limited Data: Mainly uses old price data. Missed Opportunities: May not catch new trends. | Complexity: Harder to understand how decisions are made (black box issue). Data-Heavy: Needs very good, clean data. Ongoing Updates: Must be tuned regularly. Higher Costs: More expensive to set up and run. |

This table helps show that automated trading is like a simple robot following a recipe, while AI agent trading is like a smart robot that learns and changes its recipe as it goes along.

Final Thoughts

So, what’s the difference between automated trading and AI agent trading? Traditional automated systems follow fixed rules and work well in stable markets. In contrast, AI agent trading is adaptive—it learns from new data, uses many types of information, and adjusts its strategy on the fly. While AI agents can offer better predictions and risk management, they are more complex and need continuous updates.

To maximize your returns:

- Choose a strong trading platform that offers advanced AI features.

- Develop and test a clear trading strategy.

- Use high-quality, diverse data.

- Monitor and update your system regularly.

- Combine AI insights with human judgment to make the best decisions.

Technology is a powerful tool, but it works best when used wisely. By understanding the differences and following these steps, you can harness the power of both automated and AI agent trading for a smarter, more profitable trading experience.