Wyckoff’s Method Explained: Decoding the Playground Game

Wyckoff’s Method Explained: Decoding the Playground Game

The stock market can be like a playground where the institutional investors or “Smart Money” big kids know all the tricks. They tend to rig the game in their favor, leaving retail traders or “Dumb Money” confused and frustrated. But imagine if you had a secret weapon, a means of deciphering their tricks and even turning them to your advantage.

Welcome the Wyckoff Method, an old tested technique for studying market trends and forecasting price behavior.

Wyckoff’s Method

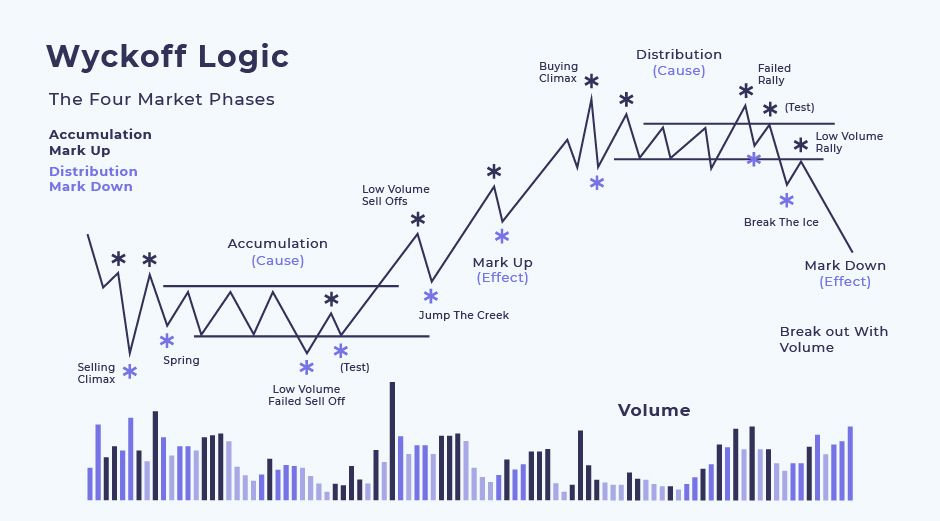

Think of the stock market as a playground where there are valuable stickers that represent assets. The Wyckoff Method teaches you how the “big kids” (Smart Money) control the “smaller kids” (retail traders) to acquire those stickers at a low price and sell them for a higher price. This control occurs in four different stages:

Accumulation: This is where the “big kids” quietly begin to accumulate stickers without making too much noise. They may even circulate rumors that the stickers are worthless in order to deceive the “smaller kids” into selling them at bargain prices. On a price chart, this stage appears as a sideways move with low volume, as Smart Money slowly accumulates the supply. One of the most important indications of strength during this stage is “jumping across the creek” (JAC), where the price breaks above the resistance level of the trading range, marking the start of the markup stage.

Markup: When the “big kids” acquire sufficient stickers, they begin generating buzz. They may be bragging about their spiffy new stickers or speculating about just how valuable they are. They become a draw to the “smaller kids,” who run and buy the stickers in great numbers, and this causes prices to rise. In a graph, this period will be indicative of a marked increase with heavy volume.

Distribution: Having made a profit, the “big kids” begin selling to the hungry “smaller kids.” They may even go so far as to feign still being a buyer in order to maintain the premium price. On the chart, this stage appears to be another sideways move, but this time on high volume, as Smart Money slowly unloads its position.

Markdown: Lastly, the “big kids” have sold the majority of their stickers and the price begins to decline. The “small kids” are left with stickers that are now worthless compared to how much they originally paid for them. On a graph, this stage depicts an apparent downward slope with greater volume.

To better grasp this manipulation of the market, Wyckoff’s Method defined the “composite operator,” which is the overall effort of large institutions and how it influences the market. He also reinforced the use of fundamental analysis integrated with technical analysis to have a broad understanding of the market.

Check Out How AI can Help to Out Smart The Big Players: Wyckoff Method & Generative AI: Outsmarting Smart Money in Trading

Wyckoff’s Method: Chart Patterns that frequently happen during these stages

Springs: A sharp decline in price that tests the support level of the trading range before bouncing back up. This is often used to shake out weak hands and create a buying opportunity for Smart Money.

Shakeouts: Just like springs, but they take place during the markup phase, where the price drops momentarily below the support level before it continues its trend upward.

He also noted that there are three kinds of trends: up, down, and flat, and these trends can be examined in three timeframes: short-term, intermediate-term, and long-term. He stressed that trends have to be learned in relation to previous behavior and that no trend ever repeats itself precisely.

Explore the synergy of Wyckoff and AI—

Wyckoff laid out a five-step stock selection and trade entry method:

In addition, Wyckoff laid out a five-step stock selection and trade entry method:

- Identify the prevailing market trend and its probable future course.

- Choose stocks that move with the market trend.

- Select stocks that are under accumulation (or distribution if selling).

- Find out if a stock is poised to move.

- Time your trade to take advantage of market turns.

He also emphasized the significance of understanding “effort versus result,” which assists in determining the strength of a trend by contrasting the price movement and the volume. For instance, if the price is rising with heavy volume, it reflects a strong uptrend.

It should be noted that the Wyckoff cycle is not always in a rigid order of accumulation, markup, distribution, and markdown. At times, the price may rise first, then “re-accumulate” before resuming the rally. Likewise, “re-distribution” can happen during a bear trend, where big sellers dispose of their holdings.

Lastly, Wyckoff’s Method suggested employing both bar charts and Point and Figure (P&F) charts in order to examine market trends and detect Wyckoff patterns.