Wyckoff Method & Generative AI: Outsmarting Smart Money in Trading

Wyckoff Method & Generative AI: Outsmarting Smart Money in Trading

The stock market can feel like a playground where the big kids (institutional investors or “Smart Money”) seem to know all the tricks. They often manipulate the game to their advantage, leaving the smaller kids (retail traders or “Dumb Money”) confused and frustrated. But what if you had a secret weapon, a way to understand their tactics and even use them to your benefit? Enter the Wyckoff Method, a time-tested approach to analyzing market trends and predicting price movements. And now, with the power of Generative AI, this classic method is getting a modern upgrade, offering retail traders a chance to level up their trading game and potentially level the playing field with institutional investors.

Core Principles of the Wyckoff Method

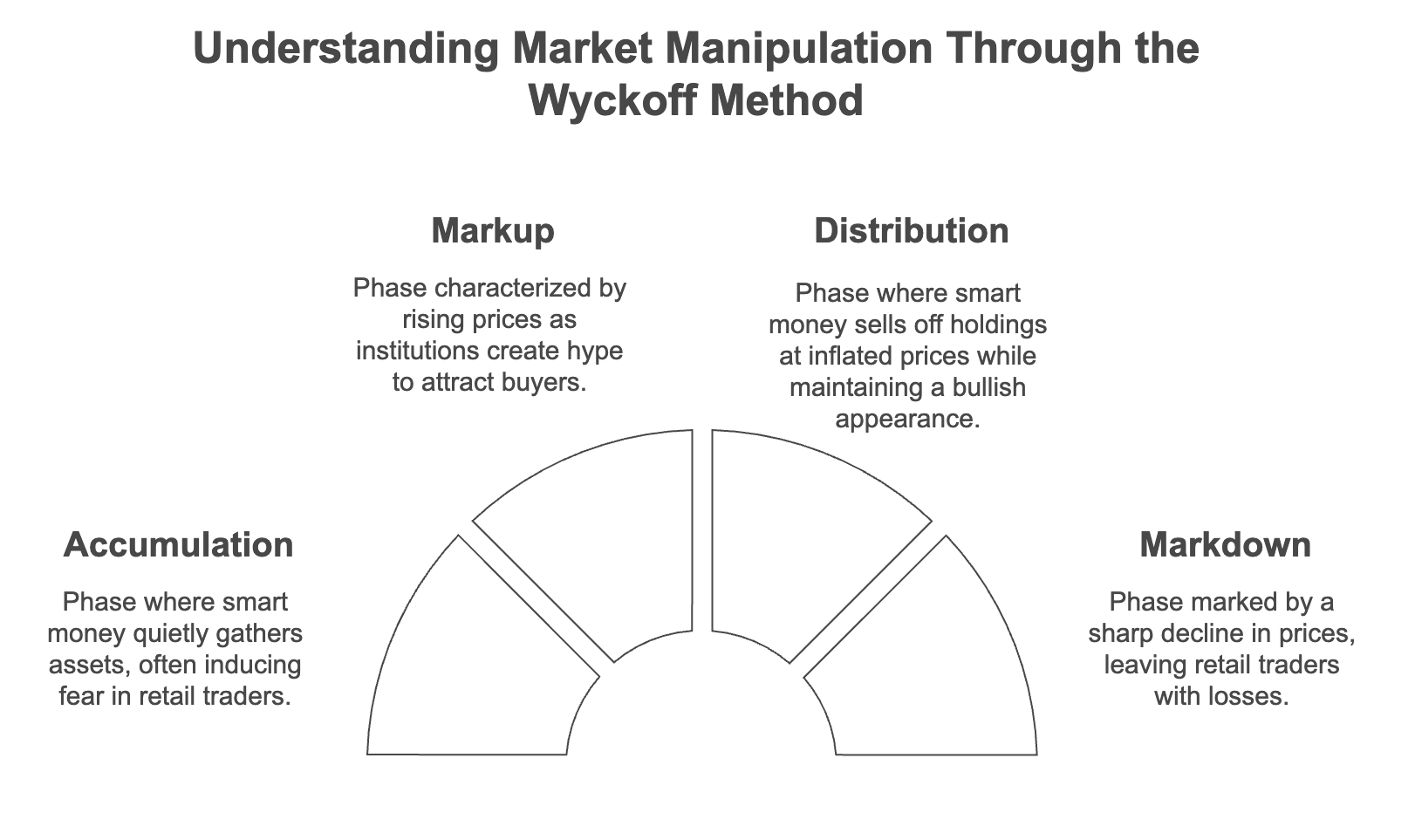

The Wyckoff Method is a framework for understanding market cycles driven by institutional manipulation. It breaks down price action into four phases:

- Accumulation: Smart Money quietly accumulates assets, often creating fear to force retail traders to sell. Charts show sideways movement with low volume, marked by bullish signals like the “Jump Across the Creek” (JAC).

- Markup: Prices rise as institutions generate hype, attracting retail buyers. Charts reflect strong uptrends with increasing volume.

- Distribution: Smart Money offloads holdings at inflated prices while maintaining bullish appearances. Charts show sideways movement with high volume.

- Markdown: Prices collapse post-distribution, leaving retail traders with losses. Charts display sharp downtrends.

Key concepts include the Composite Operator (collective institutional influence), Effort vs. Result (volume-price analysis), and patterns like springs (false breakdowns) and shakeouts (dips to trap traders). Wyckoff’s five-step trading framework emphasizes trend alignment, stock selection, and timing entries/exits.

dive deeper into how Smart Money manipulates trends—and how you can outsmart them. Our full blog, Wyckoff’s Method Explained: Decoding the Playground Game

Automating Wyckoff Pattern Recognition with AI

Generative AI is like having a “playground lookout” that analyzes the game, predicts what the “big kids” may do, and warns you of traps ahead. This technology can dramatically enhance the accuracy and speed in trying to spot Wyckoff patterns-the holy grail of technical analysis-around which successful trading gravitates. Here’s how this powerful technology can advance the Wyckoff Method in the aid of retail traders to identical tools and insights that previously only institutional investors enjoyed.

1. Automation of Pattern Recognition: Generative AI will scan through vast amounts of market data and recognise the Wyckoff phases with better accuracy and speed compared to traditional methods. It allows retail traders to notice accumulation and distribution phases early in the game, giving them a valuable edge.

Check out best AI Agents for Automation: 10 AI Agent Tools That Are Reshaping the Algorithmic trading Industry in 2025

2. Forecasting Manipulation in Markets: Based on analysis of history data and trends related to the activity of Smart Money, Generative AI can identify patterns that forecast future “stop hunts” in the form of “price traps,” where institutions may buy upon being stopped, as well as “liquidity grabs,” whereby massive orders absorb existing liquidity for purposes of moving prices.

3. Analyze Market Sentiment Generative AI can process news articles, social media posts, and other textual data to gauge overall market sentiment and predict the potential phase transitions. These help traders further confirm their analysis and make informed decisions. This analysis involves several key components:

- Data aggregation Let’s gather relevant textual data from different sources.

- Data cleaning and preprocessing Cleaning and standardizing the text format.

- Natural Language Processing (NLP): Apply NLP methods for sentiment detection along with intensity.

- Statistical and data analysis: Draw inferences from the sentiment pattern over time

- Visualization: Show the trend in sentiment by plots and charts.

Acuity’s AI Technology provides real-time alerts of sentiments, deeper understanding of changes in sentiments, and seamless integration into trading platforms. AI assistants are also increasingly important for sentiment analysis because they provide a cleaner and more intentional dialogue environment than social media. Apart from that, generative AI can help embed text into large language models for faster insights, which becomes quite efficient in analyzing market sentiments.

4. Generate Synthetic Data: Generative AI can create realistic market scenarios for the backtesting of trading strategies to refine entry and exit points. This enables traders to test their strategies in a risk-free environment and optimize their performance.Synthetic data can be used for testing and refining trading algorithms and for risk management. Several techniques are used to create synthetic financial data, such as rules engines, entity cloning, and data masking.

5. Provide Real-time Alerts: AI-powered platforms can monitor markets 24/7 and alert traders of potential phase changes or manipulation attempts, enabling them to react quickly and capitalize on opportunities. Some platforms, like Trade Ideas, offer features like the Money Machine, which automatically positions traders in the top 3 performing stocks based on momentum

Practical Uses for Retail Traders

Having Generative AI as their “playground lookout,” retail traders can:

- Detect accumulation/distribution stages in advance: Automated tools can scrutinize price and volume information for faint indications of institutional buying/selling, and traders can therefore get into position ahead of price action.

- Steer clear of manipulation traps such as stop hunts: By identifying patterns of Smart Money action, AI can alert traders to possible stop hunts, so they may reposition their stop-loss orders or perhaps exploit these situations for profit.

- Verify markup stages with sentiment and volume analysis: AI is able to analyze sentiment and volume information to verify the power of an uptrend, allowing traders to stay away from false breakouts and catch the wave of institutional buying.

- Mitigate risk: AI can be employed in the management of risk through monitoring of market trends and possible disruptions like fluctuations in freight rates or economic instability.

- Optimize portfolio management: AI can analyze market sentiment and provide insights for portfolio optimization, helping traders make informed decisions about their investments.

- Access various uses of AI-powered sentiment analysis: These range from uses in retail, crisis management, and product development, giving traders a wider perspective of market dynamics and consumer behavior.

Challenges and Considerations

While Generative AI offers significant advantages, it’s essential to be aware of potential challenges:

- AI bias: AI models learn from past data, which can include biases that can influence their predictions.

- Data quality problems: Wrong or missing information may result in unreliable AI analysis.

- Over-dependence on AI: Traders must never entirely depend on AI and must always use its observations in combination with their judgment and critical thinking.

- Challenges of applying AI-based sentiment analysis: This encompasses processing ambiguous text, dealing with negation, handling different domains and industries, and solving imbalanced data.

- Regulatory concerns and risks of employing AI for trading: This encompasses data breaches, bias and discrimination potential, and model failure risk.

But here’s the reality: tools alone aren’t enough. To consistently outmaneuver Smart Money, you need to build systems—not just follow signals.

Conclusion

Generative AI has the power to transform how retail traders apply the Wyckoff Method. Through automating pattern identification, anticipating market manipulation, sentiment analysis, synthetic data generation, and real-time alerting, AI equips traders with the tools and information they require to overcome the intricacies of the market and make better-informed decisions. By combining these capabilities, retail traders can potentially equal the playing field with institutional investors by offering access to sophisticated analytical tools and real-time market insight.

Although there are still challenges, the future of trading is certainly inextricably linked with AI. Those traders who adopt this technology and merge AI insights with their own experience and expertise will be well placed to thrive in the changing world of financial markets.