NexusTrade Review: A Deep Dive into AI-Powered No-Code Trading

NexusTrade Review: A Deep Dive into AI-Powered No-Code Trading

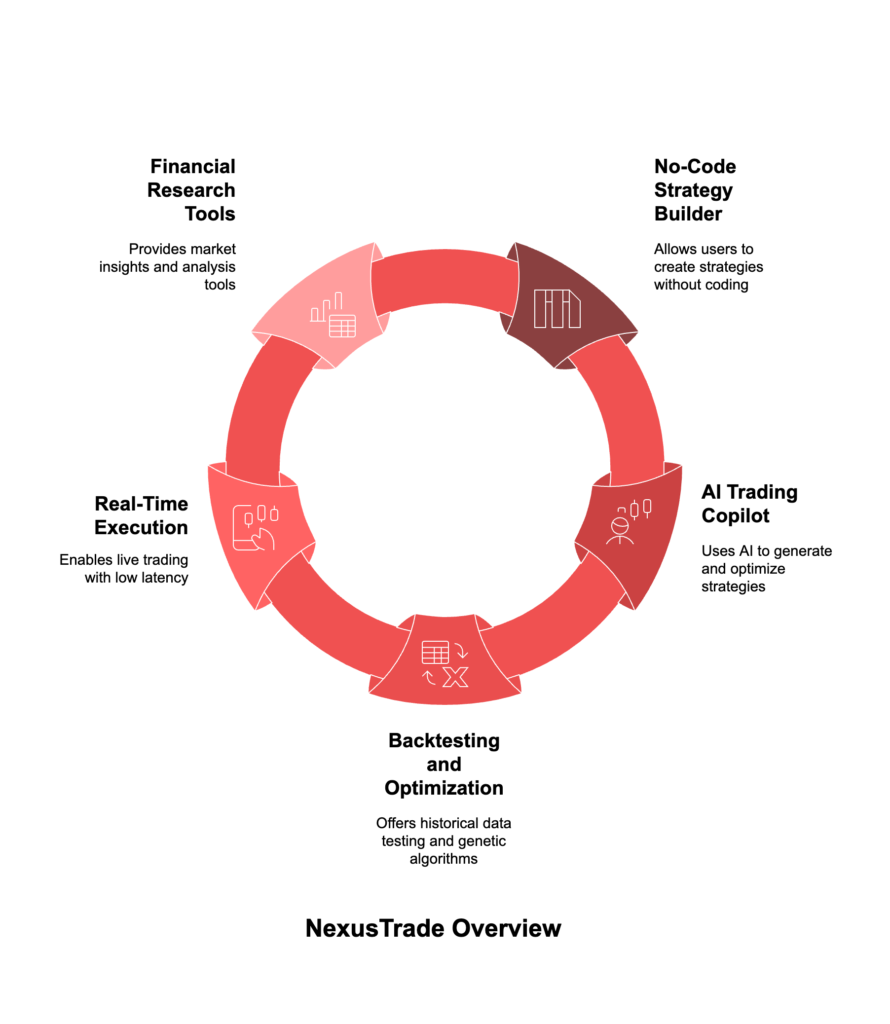

As financial markets evolve, algorithmic trading has become increasingly popular among traders looking for efficiency and automation. However, traditional algorithmic trading often requires coding skills and access to complex data, creating a barrier for many traders. NexusTrade seeks to bridge this gap by providing an intuitive, no-code platform powered by AI, allowing traders of all experience levels to build, test, and deploy automated strategies seamlessly.

With AI-powered, no-code solutions, NexusTrade simplifies access to algorithmic trading, enabling traders to design and implement strategies without programming knowledge. While its ease of use is a strong advantage, how does it compare to other platforms in terms of features and effectiveness? Moreover, how does it fit into the broader landscape of Automated Trading vs. AI Agent Trading? To better understand this difference, you can read more about it here.

How NexusTrade Works: Features and Real-World Viability

NexusTrade is designed to simplify algorithmic trading by integrating AI-driven automation with an intuitive, user-friendly interface. Below is a breakdown of its core functionalities:

1. No-Code Strategy Builder

At the heart of NexusTrade is its no-code strategy builder, which enables users to create automated trading strategies using a drag-and-drop interface. Traders can select pre-built indicators, define entry and exit rules, and set risk management parameters—all without needing programming expertise.

This feature is particularly useful for traders who want to automate their trading without spending months learning how to code. However, no-code solutions often come with some limitations in customization compared to platforms that allow scripting or API integrations, such as QuantConnect or MetaTrader 5.

2. AI Trading Copilot (Aurora): An Added Advantage?

One of NexusTrade’s standout features is Aurora, an AI-powered trading assistant that helps users generate and optimize strategies. Aurora uses natural language processing (NLP) to interpret user queries and convert them into actionable trading models. This means a trader can simply type, “Create a strategy that buys Bitcoin when the RSI is below 30 and sells when it’s above 70,” and Aurora will handle the rest.

Compared to platforms like Coinrule, which also provides an automation builder, NexusTrade’s AI-driven approach provides a more intuitive experience. However, while AI-based strategy generation is promising, users should still validate the strategies with rigorous testing before committing real capital.

3. Backtesting and Optimization: A Critical Tool

Backtesting is a crucial part of any trading strategy, and NexusTrade offers historical data backtesting to validate strategies before live execution. Users can:

Simulate trading performance using historical market data

Optimize strategies with genetic algorithms

Identify weak points and fine-tune trading rules to improve profitability

Platforms like TradingView, QuantConnect, and CryptoHopper also offer powerful backtesting tools, but NexusTrade differentiates itself by incorporating genetic optimization, allowing strategies to be refined over time. However, traders should remain cautious, as past performance does not guarantee future results.

4. Real-Time Execution & Automation: Is It Fast Enough?

Once a strategy is built and tested, users can deploy it for real-time execution on supported exchanges. NexusTrade ensures low-latency order execution, reducing slippage and maximizing efficiency.

When compared to platforms like MetaTrader 5, which is widely used by professionals, NexusTrade has the advantage of simplicity but lacks the advanced order routing and execution speed that institutions rely on. Retail traders should find its execution speed sufficient, but those involved in high-frequency trading may need more sophisticated solutions.

5. Financial Research & Market Insights: A Well-Rounded Feature

Beyond trading automation, NexusTrade provides powerful research tools, including:

Stock Screeners: Identify stocks that meet specific financial and technical criteria.

Fundamental Analysis: Access key financial indicators like P/E ratios, earnings reports, and macroeconomic trends.

Sentiment Analysis: AI-powered tools scan news, social media, and analyst opinions to provide a market sentiment outlook.

While many platforms, such as ThinkorSwim, TrendSpider, and Bloomberg Terminal, provide in-depth market research, NexusTrade integrates these insights into its automation tools. However, traders requiring deep financial modeling may still prefer dedicated research platforms.

Competitor Comparison: How Does NexusTrade Stack Up?

To better understand NexusTrade’s positioning, here’s how it compares with key competitors:

NexusTrade stands out with AI-assisted strategy creation and genetic optimization, but it falls short on custom coding flexibility compared to platforms like QuantConnect and MetaTrader 5. Meanwhile, CryptoHopper offers a comparable AI-powered trading assistant but with more exchange integrations.

Final Verdict: A Promising Platform with Room to Grow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, p

What NexusTrade Does Well:

No-code strategy creation makes algorithmic trading accessible.

AI-powered assistant simplifies strategy development.

Backtesting and genetic optimization improve strategy refinement.

Research tools integrate market insights directly into trading strategies.

Where It Can Improve:

Limited customization options compared to coding-based platforms.

AI-generated strategies require rigorous validation.

Lacks advanced execution features for institutional traders.

Final Thought:

NexusTrade provides an accessible entry point for retail traders and newcomers looking to automate their strategies without coding knowledge. Its AI-powered tools and backtesting capabilities make it a strong contender in the algorithmic trading space. However, advanced traders may find the lack of customization and API integrations limiting. If NexusTrade continues to expand its features, especially in execution tools and advanced strategy development, it has the potential to become a more competitive choice for all types of traders.