AI in financial services: How Intelligent Automation is Transforming Finance

The banking industry is rapidly embracing generative AI (GenAI) to transform operations, enhance customer experiences, and boost profitability. In 2023, the global GenAI market in finance was valued at approximately $1.09 billion, with projections indicating a surge to over $12 billion by 2032.

This swift adoption is evident as 58% of banking organizations have already fully integrated GenAI into their operations, a significant increase from 45% in 2023. Major financial institutions like JPMorgan Chase are leading the charge, utilizing GenAI to enhance data processing capabilities, improve security, and scale services effectively.

As GenAI continues to reshape the financial landscape, banks are poised to unlock unprecedented value and redefine industry standards.

The GenAI Revolution in Banking Operations

Simplifying Complex Processes

Modern banking operations are complex, requiring high levels of efficiency and precision. Generative AI is stepping in to automate processes, reduce costs, and enhance decision-making across financial institutions.

A standout example is JPMorgan Chase, which has rolled out a suite of Large Language Models (LLMs) to streamline workflows, improve employee productivity, and enhance customer service (WSJ). Similarly, Goldman Sachs has reinforced its AI strategy by hiring Daniel Marcu, a former Amazon executive, to lead AI engineering efforts .

Beyond internal efficiencies, GenAI is also improving the customer experience. For example, Commonwealth Bank of Australia (CBA) launched CommBiz Gen AI, an AI-powered agent that provides ChatGPT-style assistance to business customers. This initiative is backed by a multi-year cloud partnership with AWS to scale AI capabilities.

Better Decision-Making Through Data

Banks generate vast amounts of data daily, and GenAI is helping financial institutions extract actionable insights from raw information. Through predictive analytics, AI can analyze historical trends, customer behaviors, and market conditions to anticipate potential risks and opportunities.

For example, automated reporting powered by AI is replacing traditional static reports with real-time, adaptive insights that help decision-makers react to market changes instantly. Instead of manually compiling financial summaries, AI-driven tools generate risk assessments, performance forecasts, and strategic recommendations on the fly.

With the adoption of GenAI, banks are shifting from reactive decision-making to proactive strategies, ensuring they stay ahead in an increasingly competitive industry.

Reinventing Recruitment in Financial Institutions

The competition for top talent in the financial industry is more intense than ever, and forward-thinking banks are using GenAI to streamline recruitment. AI-powered tools analyze candidate profiles, identifying trends linked to success in specific financial roles. The goal isn’t to replace human decision-making but to enhance it with data-driven insights that reduce bias and improve hiring efficiency.

Resume screening is one of the most time-consuming aspects of recruitment, especially for large institutions handling thousands of applications. GenAI tools can quickly identify relevant experience, skills, and achievements while adapting to the specific requirements of each role. This automation frees up recruitment teams to focus on engaging with top candidates rather than manually reviewing applications.

The onboarding process has also evolved with GenAI. Personalized training programs adapt to individual learning styles and knowledge gaps, helping new hires become productive more quickly. AI-powered assistants further support new employees by answering questions about company policies, systems, and procedures—allowing HR teams to focus on strategic initiatives.

Reimagining Customer Service with AI

Personalization at Scale

Traditional banking models often treat all customers the same, but in reality, every individual has unique financial needs. Generative AI (GenAI) is changing this by enabling hyper-personalization—analyzing transaction history, spending habits, and life events to recommend tailored financial products and services.

For example, if a customer frequently travels abroad, AI can automatically identify travel-related purchases and suggest solutions such as foreign currency accounts, travel insurance, or credit cards with international perks. Instead of generic promotions, banks can now offer real-time, relevant recommendations, improving customer satisfaction and engagement.

24/7 Intelligent Assistance

AI-powered chatbots and virtual assistants are revolutionizing customer service in banking. Unlike traditional chatbots that simply provide FAQ answers, modern Conversational AI systems handle complex queries, assist with financial planning, and even give tailored investment advice. These AI-driven assistants continuously learn from interactions, becoming smarter over time and reducing the need for human intervention.

Another breakthrough is Sentiment Analysis, where AI detects customer frustration, confusion, or urgency in real-time. If a user struggles with a transaction or expresses dissatisfaction, the system escalates the issue automatically to a human agent, ensuring faster resolutions and improved customer experiences. This technology not only enhances efficiency but also builds stronger relationships between banks and their customers.

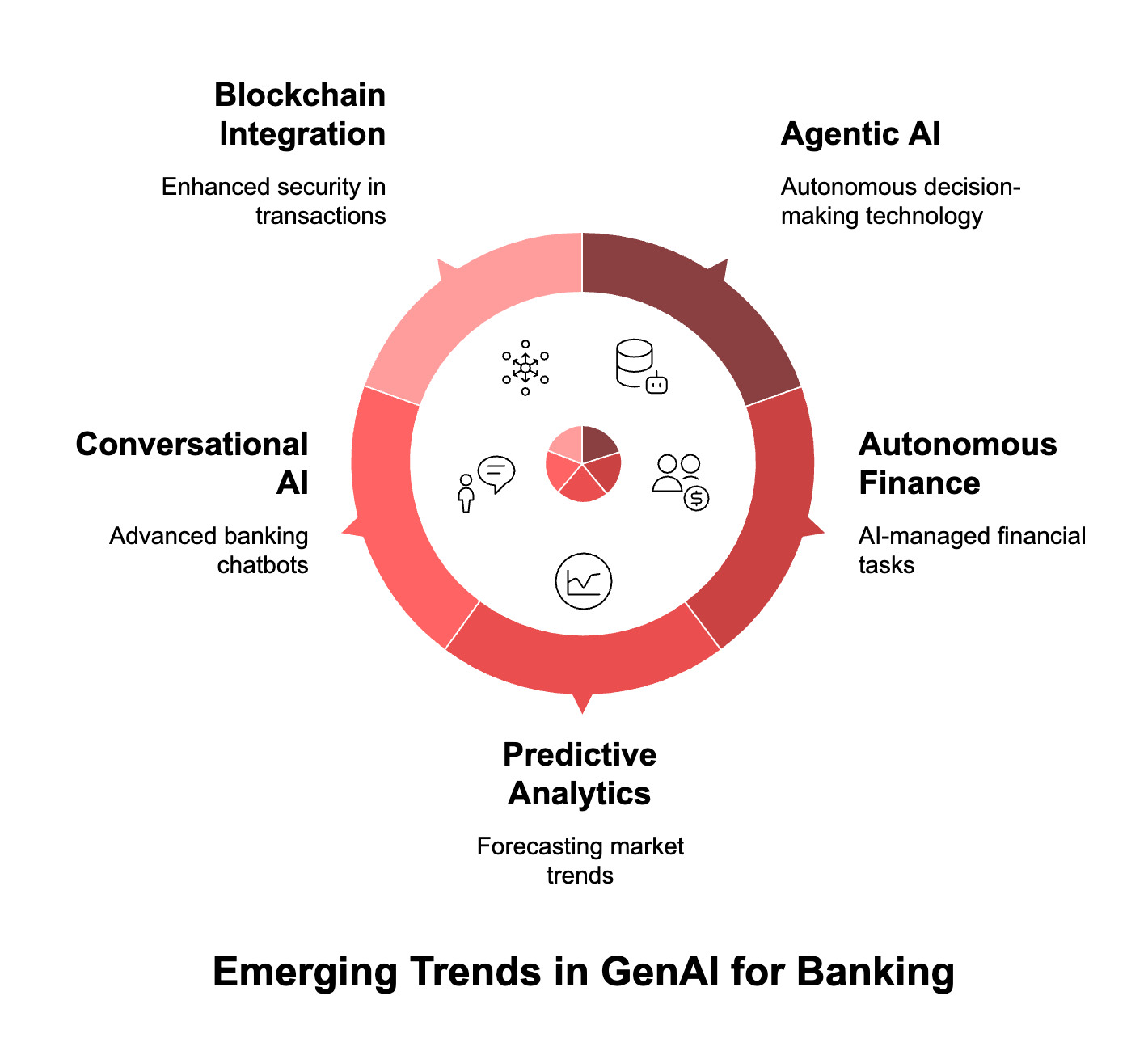

Emerging Trends in GenAI for Banking

Agentic AI: The Next Frontier

Agentic AI represents the next stage in AI evolution, enabling independent decision-making and adaptive workflows. Unlike traditional automation, this technology can manage multi-step banking processes with minimal human intervention, reducing inefficiencies and enhancing decision-making capabilities.

A real-world example comes from a global bank that implemented an Agentic AI system to manage liquidity risk. The AI autonomously analyzes real-time cash flow data, interbank rates, and geopolitical events to optimize liquidity management without direct human oversight (Medium). This ability to proactively adapt to financial conditions helps institutions mitigate risk and improve financial stability.

As financial markets evolve, Agentic AI is expected to play a larger role in automating compliance, fraud detection, and customer engagement—allowing banks to reduce costs while improving service quality.

Autonomous Finance

Autonomous finance refers to AI-driven financial management systems that automate everyday banking and investment tasks without human intervention. This growing trend allows financial institutions to offer self-operating services that help customers manage finances more effectively.

A leading example in 2025 is AI-powered invoice processing and payment automation. Platforms like Vic.ai enable banks and businesses to autonomously capture, process, and execute financial transactions—reducing manual data entry and minimizing errors.

Autonomous finance is also improving personal financial management by automating savings, loan repayments, and investment strategies. AI systems analyze spending patterns and market conditions to proactively allocate funds, rebalance portfolios, and optimize wealth-building strategies.

By integrating autonomous finance solutions, banks can provide seamless, intelligent financial services that enhance customer convenience and financial well-being while reducing operational overhead.

Predictive Analytics

Predictive analytics leverages historical and real-time data to forecast future financial trends, enabling banks to make data-driven decisions. SaaS solutions specializing in predictive analytics, like nCino, provide cloud-based platforms that allow financial institutions to analyze risk, optimize loan approvals, and improve overall efficiency.

By integrating predictive analytics, banks can move from reactive to proactive strategies—anticipating customer needs, detecting fraud in real-time, and identifying investment opportunities before they arise.

Advancements in predictive analytics are enabling banks to forecast market trends and financial outcomes with greater accuracy. AI models process vast amounts of historical and real-time data to identify risks and opportunities before they become apparent. This capability allows financial institutions to make smarter decisions about investments, loans, and risk management.

Conversational AI

Conversational AI enables human-like interactions between banks and customers through AI-powered chatbots and virtual assistants. SaaS providers such as Gupshup and Interactions LLC offer advanced AI-driven customer engagement platforms that allow banks to automate inquiries, provide real-time financial advice, and assist with transactions.

For example, Commonwealth Bank of Australia (CBA) launched CommBiz Gen AI, an AI-powered banking assistant that helps business clients with financial queries, streamlining their banking experience.

With rapid advancements in natural language processing (NLP), conversational AI is no longer limited to simple chatbot interactions—it is now capable of handling complex financial transactions, fraud detection, and hyper-personalized financial guidance, improving both customer experience and operational efficiency.

Conversational AI continues to evolve, with improvements in natural language processing making banking interactions more seamless. AI-powered assistants can now handle complex financial transactions, provide personalized investment advice, and even assist with tax planning. These systems are becoming increasingly proactive, offering customers tailored financial strategies based on their behaviors and market conditions.

The Future Horizon of AI in Banking

Looking ahead, the integration of GenAI with other emerging technologies promises even more transformative possibilities. Imagine AI systems that not only analyze current financial data but predict market shifts weeks or months in advance with increasing accuracy. Or consider the potential of AI-driven wealth management platforms that provide real-time investment advice tailored to individual risk tolerances and financial goals.

The most innovative banks will likely combine GenAI with Internet of Things (IoT) data, creating comprehensive financial ecosystems that anticipate customer needs before they’re explicitly stated. For example, your smart refrigerator might communicate with your bank’s AI system to manage grocery budgets automatically or identify opportunities for cost savings based on your eating habits and spending patterns.

Conclusion

Generative AI isn’t just changing banking—it’s redefining it. From operational efficiency to customer experience, its applications are expanding rapidly, giving financial institutions new ways to stand out in an increasingly digital world. As AI systems continue to evolve, they will become essential partners in helping banks navigate the complexities of modern finance while delivering unprecedented value to customers.

For a deeper dive into how AI is revolutionizing investment strategies, check out our comprehensive guide on AI Agents for Stock Trading: The Future of Investing. Whether you’re a seasoned investor or just starting out, this resource provides valuable insights into the AI-driven future of finance.