Advanced Algorithmic Trading Made Simple: Your Essential Guide(Part 1)

Advanced Algorithmic Trading Made Simple: Your Essential Guide(Part 1)

Algorithmic trading has revolutionized today’s financial markets. In the United States, the global flagship market, trading is increasingly dominated by computer programs that automatically place orders based on predefined criteria. It is presently estimated that as much as 60% to 75% of U.S. equity volume is algorithmic, thus enabling institutions and even individual traders to utilize speed, accuracy, and data-based tactics.

This technology has leveled the playing field for sophisticated approaches to trading. Whether you are an institutional trader or an individual investor, understanding the dynamics of algorithmic trading is crucial. In this blog, we will establish the fundamental concepts, contrast different styles of trading, and demonstrate how one can leverage new innovations like artificial intelligence to improve one’s trading methodology—all while placing our discussion in real-world examples and working code snippets of 2025.

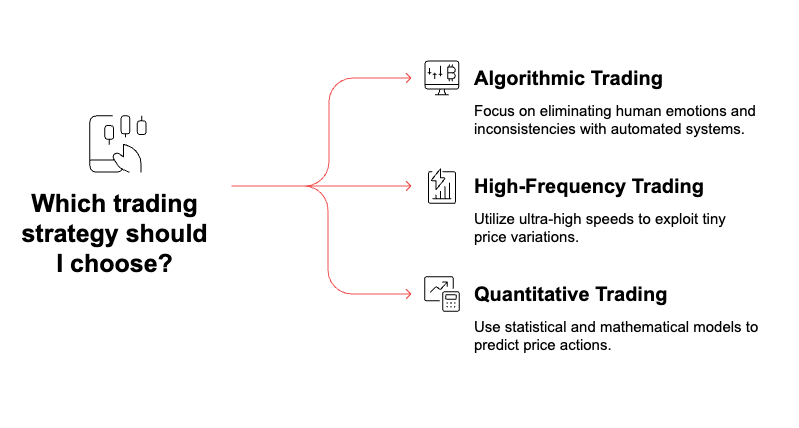

Algorithmic Trading versus High-Frequency Trading versus Quantitative Trading

While these terms are sometimes used interchangeably, each speaks to a distinct aspect of modern market strategy:

Algorithmic Trading

- Definition: Computer-based automated trading decisions. Computer programs analyze market data, create trading signals, and execute orders automatically.

- Basic Principle: Eliminate human emotions and inconsistencies by applying fixed principles rigidly.

- Practical Impact: From simple moving average crossovers to highly complex multi-factor models, algorithmic trading systems place orders with regularity and velocity.

High-Frequency Trading (HFT)

- Definition: A subset of algorithmic trading focused on order execution at ultra-high speeds with positions being held for seconds or even shorter.

- Key Idea: Employ speed and advanced technology, such as co-located servers and optimized code, to take advantage of tiny price variations in different markets.

- Practical Example: An HFT system may purchase shares on one exchange and sell them milliseconds thereafter on another, profiting from a transient arbitrage opportunity.

- Note: HFT is capital-intensive and is generally the province of large institutions.

Quantitative Trading

- Definition: Quantitative model-based trading derived from statistical and mathematical analysis.

- Core Principle: Employ data, past trends, and sophisticated modeling methods, often using machine learning, to predict price action.

- Overlap with Algorithmic Trading: Quantitative models that have been developed are typically employed via computer programs.

- Example: A quantitative analyst may build a model to identify when two long-correlated stocks decouple and then use pairs trading strategies to exploit their future convergence.

By grasping these distinctions, one is better positioned to make more effective choices regarding the tools and techniques that best fit one’s style—whether speed, model-driven decisions, or some mix thereof.

Strategy & System Design: Building Resilient Trading Systems

Creating a profitable algorithmic trading system takes more than simply writing an innovative idea. It is an art that entails a proper mixture of strategy formation, risk management, and diligent system design.

1. Developing a Trading Plan

All algorithms begin with a hypothesis:

- Technical Analysis: For instance, a rule for investment may say buy when a short-term moving average crosses above a long-term moving average.

- Statistical Arbitrage: This approach exploits pricing anomalies between related securities. A prevalent method employed in this context is pairs trading; if two historically correlated stocks diverge in price by a statistically significant margin, one may short the outperformer and buy the underperformer, anticipating that the prices will converge.

- Quantitative Models: Sophisticated approaches can include machine learning models that forecast price action based on the examination of hundreds of features, from technical patterns to sentiment.

The trick is to establish specific entry and exit criteria that can be applied by a computer without hesitation or emotional bias.

2. Risk Management & Strategy Rules

Not even the best plan works without effective risk management:

- Position Sizing: Keep the amount of capital in a single trade low.

- Stop-Loss Orders: Close positions that are against you automatically to prevent losses.

- Diversification: Spread risk across multiple assets or strategies.

- Market Neutrality: For statistical arbitrage-type strategies, hedging both long and short positions will offset overall market risk.

Strong risk management is the insurance that insulates your portfolio during periods of market volatility.

3. Backtesting and Optimization

Before applying any strategy, there must be intensive backtesting on past data:

- What is Backtesting? It is the practice of testing trades using historical market data to examine the performance of a specific strategy.

- Significance: Backtesting is employed to validate your concept, identify potential weaknesses, and fine-tune parameters prior to risking actual money.

- Techniques: Employ tactics such as walk-forward testing or out-of-sample testing to mitigate the risk of overfitting—a common pitfall wherein the strategy is excessively tailored to historical data and underperforms in live markets.

For example, a stat arb strategy might perform well in a trending market but not in a sideways market. Such insights allow you to add filters or adjust parameters for enhanced robustness.

4. System Technology and Architecture

A successful trading system integrates strategy and technology:

- Data Feeds: Past and current market data are the pillars of any strategy. Without reliable data, even the best strategies will not succeed.

- Trading Engine: This is where your algorithm resides—processing incoming data, creating signals, and placing orders.

- Execution Module: Interacts directly with brokers (via APIs) to place orders and manage positions.

- Resilience: The system must be robust enough to handle connectivity issues, data latency, or hardware failure. Redundant servers, fail-safes, and rigorous testing ensure uninterrupted operation.

New trading systems tend to employ languages such as Python for development and research, while lower-level languages (like Java or C++) are often used for high-frequency execution when speed is paramount.

5. An Illustrative Example: The Implementation of Statistical Arbitrage

Suppose there is a statistical arbitrage strategy that observes two strongly correlated stocks, such as Visa and MasterCard. The strategy:

- Calibration: Uses historical data to determine the average price spread and standard deviation.

- Signal Generation: When the spread drifts more than two standard deviations apart, it initiates a trade—short selling the out-of-sync stock and going long on the other.

- Trade Exit: When the spread returns to normal, the system closes the positions, ideally generating a small profit on each pair.

Backtesting this strategy against several years of data can help verify its effectiveness and fine-tune risk parameters, ensuring the system is not overoptimized to historical conditions.

Applying AI in Trading: Live Case Studies and Code Examples

The rapid pace of Artificial Intelligence (AI) advancement has been a revolutionary force in algorithmic trading. AI enhances decision-making by processing vast amounts of data and identifying subtle patterns that may go unnoticed by traditional models.

How AI is Revolutionizing Trading

- Predictive Analytics: Sophisticated AI algorithms such as neural networks and ensemble techniques forecast short-term price action with greater sophistication. For example, advanced AI might analyze hundreds of factors—from historical price trends and technical analysis to news sentiment—to predict a stock’s direction.

- Adaptive Algorithms: Unlike static rules, AI algorithms learn and adapt to shifting market conditions by retraining on new data, ensuring that strategies remain effective over time.

- Sentiment Analysis: Natural Language Processing (NLP) allows AI to derive market sentiment from news articles, earnings reports, and social media. When combined with quantitative data, this qualitative insight can lead to more informed trading decisions.

Example:

Renaissance Technologies (a famed quantitative hedge fund) is known for using advanced mathematical models and AI algorithms to forecast price changes, feeding on vast amounts of market data.

Code Sample: Developing a Simple Machine Learning Model for Trading

Below is a basic Python illustration demonstrating how AI can be integrated into a trading strategy using a Random Forest classifier. This model predicts whether the stock price will rise or fall the next day based on various technical indicators.

import pandas as pd

from sklearn.ensemble import RandomForestClassifier

from sklearn.model_selection import train_test_split

# Assume we have a DataFrame 'df' with historical stock data and technical indicators

# Features: Daily percentage change, 5-day moving average, 20-day moving average, 10-day volatility

features = ['PctChange1D', 'MovingAvg5', 'MovingAvg20', 'Volatility10']

X = df[features]

# Target: 1 if next day's closing price is higher, 0 otherwise

df['Target'] = (df['Close'].shift(-1) > df['Close']).astype(int)

y = df['Target']

df.dropna(inplace=True)

# Split data into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

# Initialize and train the Random Forest model

model = RandomForestClassifier(n_estimators=100, random_state=42)

model.fit(X_train, y_train)

# Evaluate model accuracy on the test set

accuracy = model.score(X_test, y_test)

print(f"Model Test Accuracy: {accuracy:.2%}")

# Example usage: Predicting the next day's move based on the latest features

latest_features = X.tail(1)

prediction = model.predict(latest_features)

if prediction[0] == 1:

print("Buy signal: Model predicts an upward move.")

else:

print("Sell signal: Model predicts a downward move.")

In this example, our dataset is prepared with several technical characteristics. The target variable is set to determine if the stock price will increase the next day. A Random Forest classifier is trained and its performance is validated. Finally, the trained model is used to generate a trading signal based on the latest available data. In a real-time system, you would continue to add functionality such as sentiment scores, cross-validation, and continuous retraining as new data arrives.

Final Thoughts and Future Steps

The first part of our guide has laid a strong foundation: defining key terms by distinguishing algorithmic trading, HFT, and quantitative trading; outlining the importance of developing, testing, and optimizing trading ideas with an emphasis on risk management, backtesting, and robust system design; and exploring how AI is revolutionizing trading with practical examples and code snippets.

If these insights are beneficial, check out our related cluster blog, “Mastering Trading Strategies: Algorithms, Statistical Arbitrage & AI,” which provides an even deeper exploration of strategy creation and the use of artificial intelligence.

Part 2 will include crucial elements such as data collection, integration of APIs, and the selection of appropriate trading platforms and infrastructure for deploying algorithms in a live environment. Stay tuned as we extend this foundation to help you align your strategy with the markets through the right data and technology.

FAQs

What is algorithmic trading, and how does it differ from high-frequency trading (HFT)?

Algorithmic trading automates trade execution based on predefined rules, while HFT is a specialized form of algorithmic trading that focuses on executing trades at ultra-fast speeds, often within milliseconds.How does quantitative trading relate to algorithmic trading?

Quantitative trading uses mathematical models and statistical analysis to develop trading strategies, which are then executed automatically through algorithmic systems.Why is backtesting crucial in algorithmic trading?

Backtesting simulates a strategy using historical data, helping to validate the trading hypothesis, optimize parameters, and identify potential pitfalls before deploying real capital.