Why 90% of Backtests Fail and how GenAI can fix it!

Approximately 90% of backtests yield inaccurate or misleading results. This is the primary reason why many carefully developed algorithmic trading systems fail when applied to live markets. Even with measures like out-of-sample data, cross-validation, or walk-forward analysis, backtest results often lean overly optimistic. In fact, most trading systems that appear profitable in backtests turn out to be unprofitable in real-world scenarios. In this article, I’ll explore the root causes of this issue and outline steps to address it.

Imagine you’re developing an algorithmic trading strategy, adhering to all the standard rules of proper system development. However, you may not realize that your trading algorithm lacks a statistical edge. Essentially, the strategy has no inherent value, its rules equating to random trading, and its profit expectancy – excluding transaction costs – is zero. The challenge is this: a backtest rarely reflects this reality with a clear zero result. If the outcome is negative, it’s natural to tweak the code, adjust parameters, or change assets and timeframes until a profitable backtest is achieved. With random modifications, this happens surprisingly quickly. This is why so many strategies with seemingly impressive backtest results fail to perform in live trading.

Does this mean backtests are useless? Absolutely not. But it’s crucial to understand when a backtest can be trusted—and when it cannot. Leveraging generative AI for anomaly detection, parameter optimization, and stress-testing scenarios can significantly enhance the reliability and applicability of backtesting results.

Table of Contents

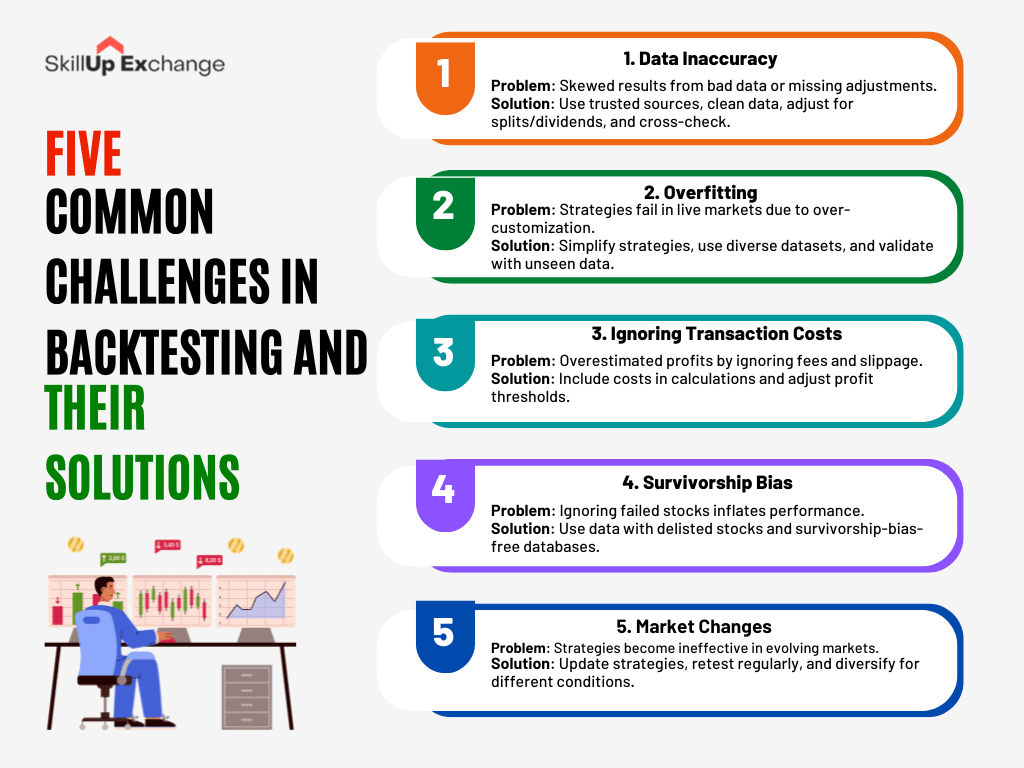

Common Challenges in Backtesting and Their Solutions

Backtesting is a vital component of developing and validating trading strategies. However, it presents several challenges that can lead to misleading conclusions if not properly addressed. Below, we explore these common challenges in detail and provide actionable solutions to enhance the reliability of your backtesting process.

1. Data Inaccuracy

Problem:

Using unreliable or incomplete historical data can significantly skew results, leading to flawed strategy evaluations. Inaccurate data may arise from various sources, including incorrect price feeds, missing data points, or failure to adjust for corporate actions such as stock splits and dividends. This issue can distort performance metrics and mislead traders about the viability of their strategies.

Solution:

To mitigate data inaccuracies, it is crucial to source data from reputable providers such as Yahoo Finance, OpenBB, or Alpha Vantage. These platforms offer comprehensive datasets that are regularly updated and maintained. Additionally, thorough data cleaning and preprocessing should be conducted. Generative AI can further enhance data preprocessing by utilizing advanced machine learning techniques such as anomaly detection algorithms to identify and correct inconsistencies in datasets. It can also employ imputation strategies like generative adversarial networks (GANs) to predict and fill in missing values based on patterns in the data. Furthermore, AI-powered tools can streamline adjustments for corporate actions by leveraging natural language processing (NLP) to analyze financial reports and execute precise modifications with minimal manual intervention. Additionally:

- Verifying Data Integrity: Check for missing values or anomalies in the dataset.

- Adjusting for Corporate Actions: Ensure that historical prices reflect any stock splits, dividends, or other corporate actions.

- Cross-Referencing Data: Compare data from multiple sources to identify inconsistencies.

2. Overfitting

Problem:

Overfitting occurs when a trading strategy is excessively tailored to historical data, resulting in a model that performs well in backtests but poorly in live markets. This happens because the strategy captures noise rather than underlying market trends, making it less adaptable to future conditions.

Solution:

To combat overfitting:

- Simplify Strategies: Focus on core components of the strategy rather than overly complex models with numerous parameters.

- Use Diverse Datasets: Test strategies across various datasets that encompass different market conditions (bull markets, bear markets, high volatility periods).

- Implement Out-of-Sample Testing: Reserve a portion of historical data for validation purposes. This helps assess how well the strategy performs on unseen data.

Generative AI can enhance this process by analyzing historical data of delisted stocks using advanced pattern recognition techniques. For instance, it can identify common precursors to delisting events, such as declining financial metrics or adverse news sentiment, providing valuable insights for risk evaluation. Additionally, generative AI models can simulate the inclusion of delisted stocks in backtesting scenarios, offering a more comprehensive understanding of how these assets might have influenced historical strategy performance.

3. Ignoring Transaction Costs

Problem:

Many traders overlook transaction costs such as brokerage fees, slippage, and commissions when backtesting their strategies. This oversight can lead to an inflated perception of profitability and unrealistic expectations about returns.

Solution:

To address this issue:

- Incorporate Realistic Transaction Costs: Factor in all relevant costs associated with executing trades. This includes commissions per trade and average slippage based on market conditions.

- Adjust Profitability Thresholds: Re-evaluate the expected returns by subtracting estimated transaction costs from gross profits to arrive at net profitability.

Generative AI can simulate realistic transaction costs under varying market conditions, offering a dynamic and comprehensive approach to cost modeling.

4. Survivorship Bias

Problem:

Survivorship bias occurs when only considering assets that have survived until the present date while ignoring those that have failed or been delisted. This bias can lead to an overestimation of strategy performance and misrepresentation of risk.

Solution:

To eliminate survivorship bias:

- Include Delisted Assets in Analysis: Use datasets that account for both active and inactive stocks. This provides a more accurate reflection of market performance over time.

- Utilize Survivorship-Bias-Free Databases: Some financial databases specifically address this issue by including historical data on companies that no longer exist.

5. Market Changes

Problem:

Financial markets are dynamic and subject to change due to various factors such as economic conditions, regulatory changes, and technological advancements. Strategies that were effective in one market regime may become ineffective in another.

Solution:

To ensure adaptability:

- Regularly Update Strategies: Continuously monitor market conditions and adjust trading strategies accordingly. This may involve re-evaluating indicators or parameters based on current trends. Generative AI can assist by identifying subtle shifts in market sentiment or anomalies in data patterns, enabling proactive adjustments to strategies.

- Conduct Periodic Retesting: Regularly backtest strategies against new data to assess their ongoing effectiveness in changing market environments. Leveraging generative AI, traders can simulate diverse scenarios and test strategies against synthetic datasets that reflect potential future market conditions.

- Diversify Strategies: Consider developing multiple strategies that are designed to perform well under different market conditions (e.g., trend-following vs. mean-reversion). Generative AI can provide insights by analyzing vast historical data and identifying correlations or hidden opportunities that can inform the creation of robust and complementary strategies.

By integrating generative AI into these practices, traders can better adapt to evolving financial landscapes, gaining deeper insights and building more resilient strategies capable of thriving under diverse and dynamic conditions.

Why Results Can Mislead Without Proper Interpretation

1. Luck vs. Skill:

High returns might result from luck rather than strategy robustness. For example, a strategy tested during a strong bull market might yield exceptional returns simply because the market was trending upwards. According to a 2018 study by “Journal of Financial Data Science,” almost 70% of high-performing strategies in simulated environments underperformed in live markets.

Solution: Analyze metrics like the Sharpe ratio, which measures risk-adjusted returns, and drawdowns to gauge the reliability of performance. For detailed insights, refer to resources like CFA Institute’s Sharpe Ratio guide.

2.Short Testing Periods:

Results from a limited dataset may not generalize to long-term performance. For instance, testing a strategy on a single year of data can overlook market anomalies, such as the dot-com bubble or the 2008 financial crisis.

Solution: Use datasets covering multiple market cycles, including bull, bear, and sideways trends. Data providers like OpenBB or Quandl offer extensive historical datasets for this purpose.

3.Cherry-Picking Data:

Focusing on favorable timeframes inflates success rates. For example, analyzing only post-pandemic stock rebounds might show unrealistic profitability.

Solution: Test strategies across random intervals or multiple asset classes to ensure robustness. A 2021 report by Quantitative Finance Journal suggests that multi-period testing reduces over-optimization by 35%.

Conclusion

Backtesting is a cornerstone of professional trading. It equips traders with the ability to validate strategies, manage risks, and approach markets with confidence. For professional traders, prioritizing backtesting ensures that decisions are rooted in data, not guesswork. Backtesting also fosters iterative improvement—a crucial aspect of thriving in ever-changing financial markets. Moreover, it’s a gateway to building strategies that adapt to different conditions, increasing the chances of sustained success.

For those interested in diving deeper into how modern tools are revolutionizing financial analysis, check out our blog: ‘5 Reasons OpenBB Transforms Modern Finance for Professionals’. It complements the insights shared here by showcasing how platforms like OpenBB simplify data access and make testing strategies seamless.

Explore advanced topics in trading strategies and consider enrolling in structured courses to deepen your understanding. Equip yourself with the right tools and knowledge to master financial markets effectively.

-

What is the importance of backtesting in trading?

Backtesting allows traders to validate strategies using historical data, ensuring their effectiveness and risk management before applying them in real markets.

-

How does OpenBB simplify financial data analysis?

OpenBB offers comprehensive tools for sourcing and analyzing financial data, making it easier for traders to perform robust backtests and refine their strategies.

-

What are common mistakes to avoid during backtesting?

Avoid overfitting strategies, neglecting transaction costs, and relying on incomplete datasets. A diversified and realistic approach ensures better results.